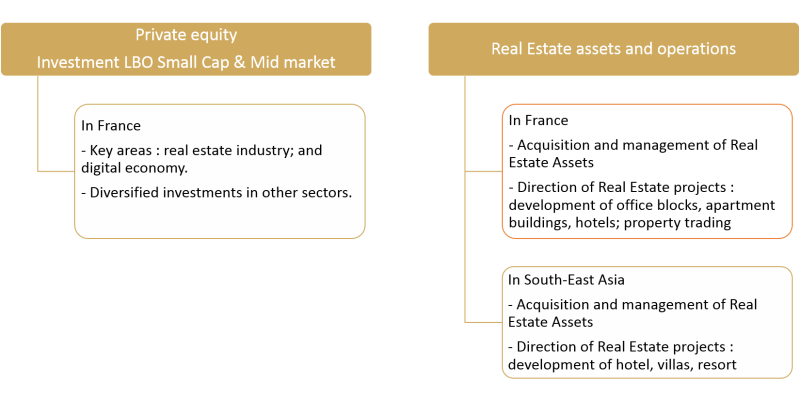

Citystar combines two core areas of expertise : Private Equity investment and Real Estate investment and operations. Our current portfolio is diversified between France (50% of invested capital) and South-East Asia (50% of invested capital).

Our Private Equity investments in France

Our main equity holdings are the following :

- a majority stake in Groupe Confiance, one of the biggest Real Estate developers of the Rhône-Alpes region. Citystar is a partner of Groupe Confiance since 2005.

- a stake in Groupe Robert Alday, the first real estate developer in Pays Basque. Citystar is a partner of Robert Alday since 2021.

- Various stakes : Valor Promotion, Famae Impact fund, CapEntrepreneurs fund by Naxicap, Purally (cosmetics start-up).

Real Estate assets and operations in France

In France, as a Real Estate investor and operator, we target both value-creating projects and investments providing returns over the medium-to-long term. We are a regular operator of Real Estate developments or property trading projects (principally housing and offices buildings renovations), in close cooperation with long term partners. We also have stakes in public Real Estate companies.

Real Estate investments in Asia

Citystar has been successfully applying its expertise in Real Estate investments and operations in South-East Asia since 2005. We principally invest in Cambodia:

- We invested in plots in Phnom Penh city center.

- Our funds own magnificent beaches in the spendid Ream / Sihanoukville region, and beach concessions on two islands.

- Finally, building up on our hospitality experience in France and in Asia, we conducted the development of the Koh Russey Villas & Resort complex, which we now operate. It is a hotel and luxury villas on the paradise island of Koh Russey.

Our Cambodian investments are managed in close cooperation between our Paris headquarters and our Singapore and Phnom Penh subsidiaries.